BRAZILIAN BUDGET DEFICIT CREATING INFLATION

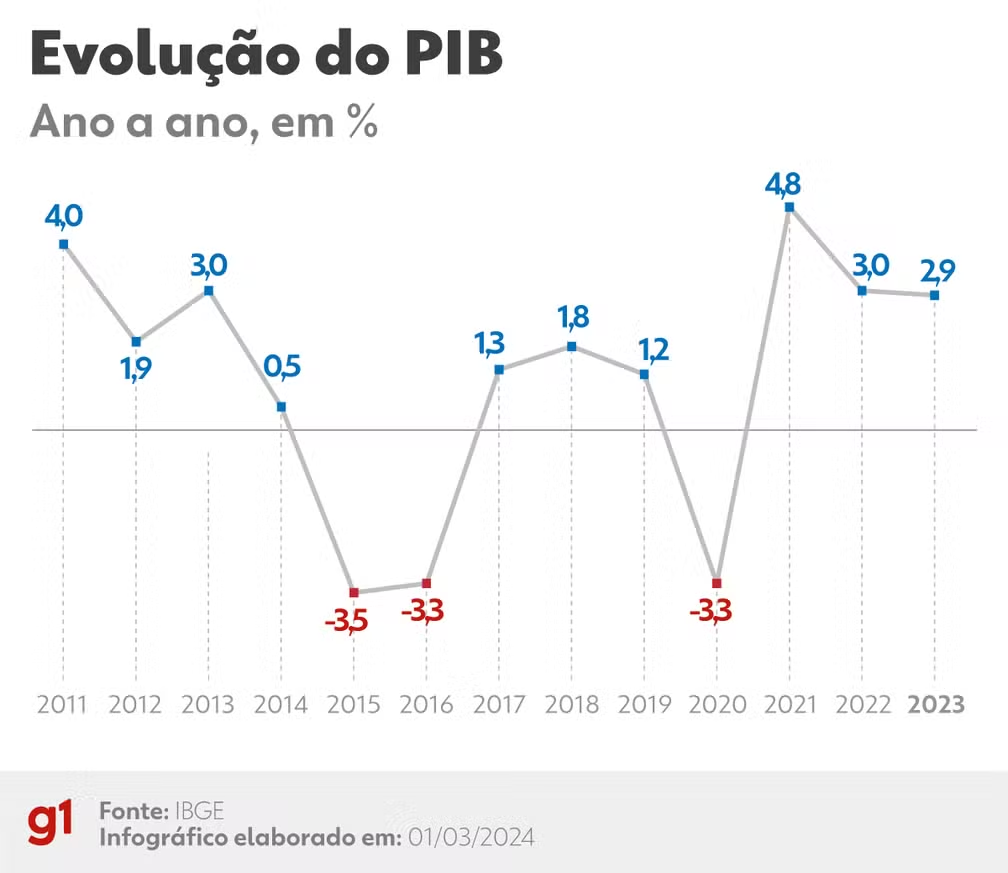

Brazilian president – Lula da Silva – wishes for the growth Brazil enjoyed in his first stint as president, when the commodities bonanza has lifted Brazilian economy to grow at 4% per year.

His populist policies are simply to increase government programs for development, so that the population enjoy a good sensation of economic frenzy.

This has done in his first and second term in office, but the consequence was a hard recession that hit the Brazilian economy afterwards and cost an impeachment of her successor in 2016.

The commodities boom is gone and now, in 2025, after a few years of spending recklessly it seems that the time to pay for the populist measures is nigh. The source of the inflation and consequent interest rate is the government budget deficit, which is caused by slow economy reducing the tax revenues, excessive spending by populist government and high interest rate, which hinders investiment.

BRAZILIAN FINANCE MINISTER INEPTITUDE

Fernando Haddad is the finance minister. He has a doctorate in Economy by USP, the best university in Brazil, but his ideas of economy are both naïve and outdated.

Haddad published his master’s dissertation on the admirable qualities of the Soviet Union in 1990, when it was already known that Socialism was a disaster. His doctorate thesis was on comparison of Marx and Habermas.

His most important position as politician was as the worst city mayor of São Paulo city and to lose the re-election on the first round.

Haddad is shy of giving interviews, but the few ones he has given has showed his naïvite on how the economy works and on how the politicians negotiate in Congress.

BRAZIL AND INFLATION

A 4,6% inflation a year is not a concern, but there are reasons why inflation is low.

The first reason is that the Brazilian Central Bank has set a whopping interest rate of 12,5%. This is the baseline for government almost risk free loans.

Comparing to the world at large, this is the fourth highest interest rate in the world. But if you discount inflation, Brazil is the highest net interest rate of all.

INTEREST RATES BY COUNTRY

| Country | Last | Previous | Reference | Unit |

|---|---|---|---|---|

| Turkey | 45 | 47.5 | Jan/25 | % |

| Argentina | 32 | 32 | Jan/25 | % |

| Russia | 21 | 21 | Dec/24 | % |

| Brazil | 12.25 | 11.25 | Dec/24 | % |

| Mexico | 10 | 10.25 | Dec/24 | % |

| South Africa | 7.75 | 8 | Nov/24 | % |

| India | 6.5 | 6.5 | Dec/24 | % |

| Indonesia | 5.75 | 6 | Jan/25 | % |

| Saudi Arabia | 5 | 5.25 | Dec/24 | % |

INFLATION RATE BY COUNTRY

| Country | Last | Previous | Reference | Unit |

|---|---|---|---|---|

| Argentina | 118 | 166 | Dec/24 | % |

| Turkey | 44.38 | 47.09 | Dec/24 | % |

| Russia | 9.5 | 8.9 | Dec/24 | % |

| India | 5.22 | 5.48 | Dec/24 | % |

| Brazil | 4.83 | 4.87 | Dec/24 | % |

| Mexico | 4.21 | 4.55 | Dec/24 | % |

| Netherlands | 4.1 | 4 | Dec/24 | % |

| Japan | 3.6 | 2.9 | Dec/24 | % |

This is grinding the economy to a slower production and the agricultural power house, the back bone of the economy in Brazil has been suffering with the high cost of loans

INTERFERENCE WITH THE INFLATION DATA

IBGE is state owned and political interference is traditional in this institute. This is the reason why there are several other institutes that publishes inflation data in Brazil, like FIPE and FGV, which have good reputations and are accepted as index for economic re-equilibrium of contracts in the annual renewal of leases.

This week a group of directors from the IGBE – Brazilian Institute of Geography and Statistics – have made public the dissatisfaction with the political partisanship that permeates the institute and the ideological persecution inside the institute by his president Marcio Porchman.

Porchman rank and file politician from PT – the workers party – the same party of the president of Brazil, Lula. His background is interventionist and statist, with multiple books published in this theme, always pushing for state intervention and wealth distribution.

MONEY MARKETS AND FUTURE

If the economics trends prevail and the finance minister does not make the corrections, Brazil will find itself in a stagflation, with high interest rates, no growth and high inflation.

This is what the money markets are signaling with the Brazilian Real dropping in value and breaking the 6,00 BR-Real per dollar psychological barrier, with no perspective of plateauing. This is due to the strength of the American currency, due to the promises of low taxes in America as well as the perspective of economic disaster due to the Brazilian budget deficit ballooning.

REFERENCES

Gestão Pochmann sugere ser alvo de ataques por apu… | VEJA

HADDAD, Fernando. O debate sobre o caráter socioecônomico do sistema soviético. 1990. Dissertação (Mestrado) – Universidade de São Paulo, São Paulo, 1990. Disponível em: https://www.teses.usp.br/teses/disponiveis/12/12138/tde-11042023-092203/. Acesso em: 25 jan. 2025.